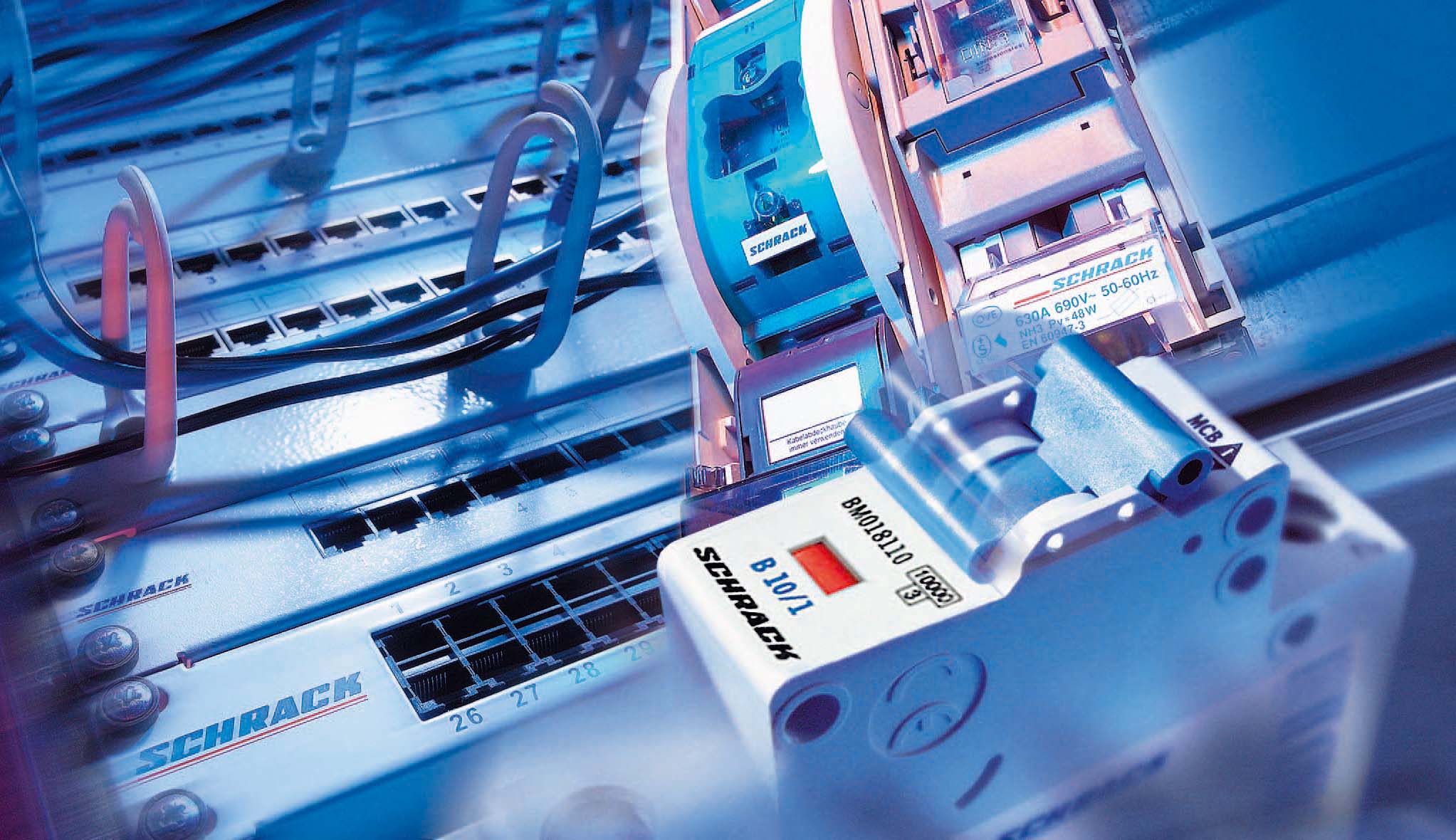

Die Schrack Technik International GmbH zählt zu den europaweit führenden Anbietern von Bauteilen und Lösungen für Energie- und Datentechnik. Das Unternehmen bietet seinen Kunden sowohl die Produkte und Lösungen als auch den Service für eine sichere, komfortable und wirtschaftliche Energieverteilung und Energienutzung in Wohn- und Gewerbeobjekten sowie im Industriebereich. Aufgrund des breitgefächerten Produktportfolios gehören sowohl Elektroinstallationsunternehmen und Schaltschrankbauer als auch Datentechnik- und Industriespezialisten zum Kundenkreis. Das Unternehmen ging 1993 als eigenständiges Unternehmen aus der Aufgliederung der Schrack AG hervor.

Mit Beteiligungskapital der Hannover Finanz realisierte Schrack die Herauslösung aus dem Rexel-Konzern sowie den Management-Buy-out und konnte anschließend während der zehn Jahre währenden Partnerschaft zu einem eigenständigen Mittelständler werden und weiter wachsen.